hotel tax calculator bc

Some communities such as Downtown Victoria have an. 21 In this regulation unless the context otherwise requires section 1 of the Act shall apply.

Realtymonks One Stop Real Estate Blog Real Estate Marketing Real Estate Easy Loans

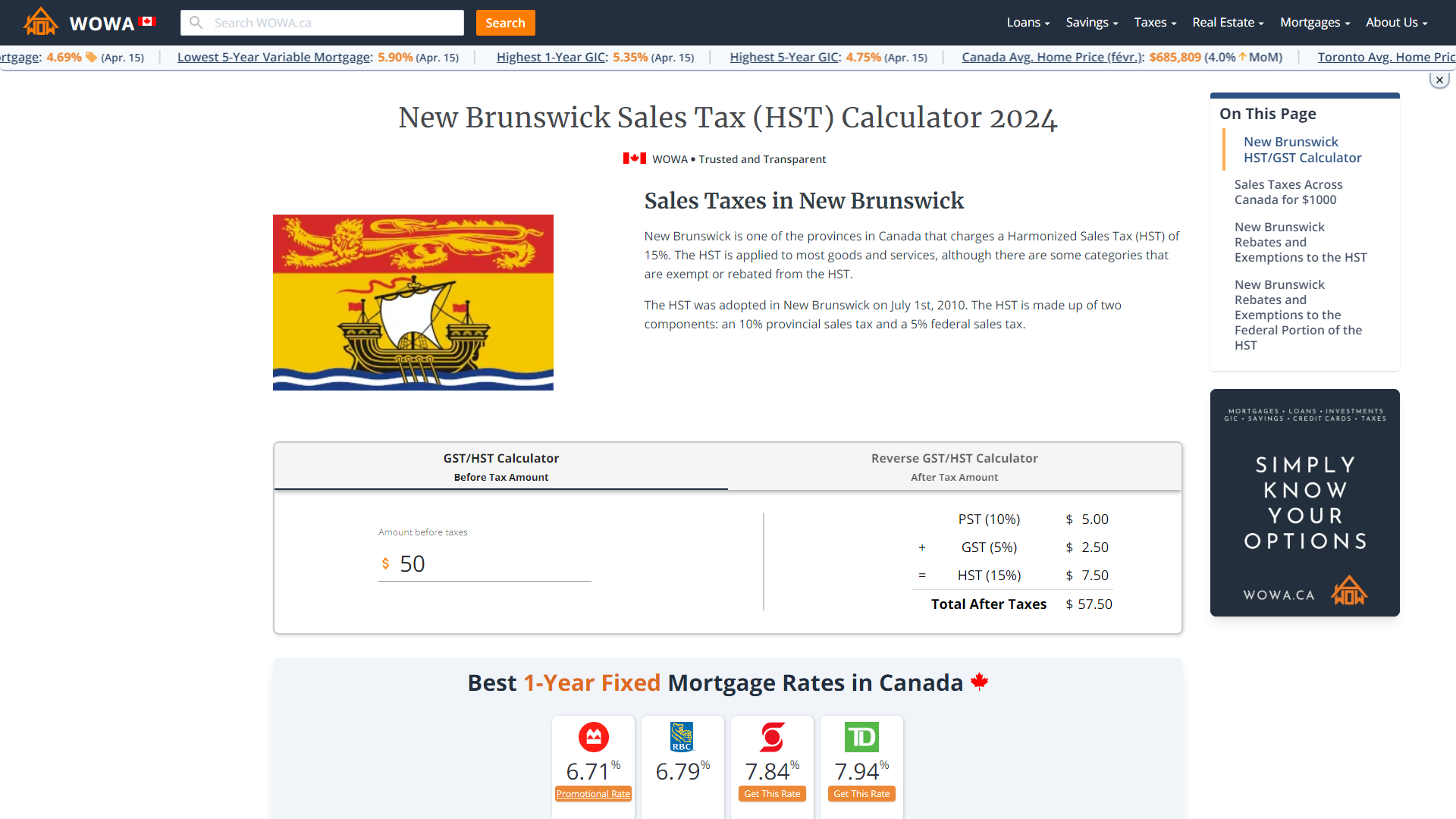

The following table provides the GST and HST provincial rates since July 1 2010.

. Ad Finding hotel tax by state then manually filing is time consuming. Ad Finding hotel tax by state then manually filing is time consuming. Avalara automates lodging sales and use tax compliance for your hospitality business.

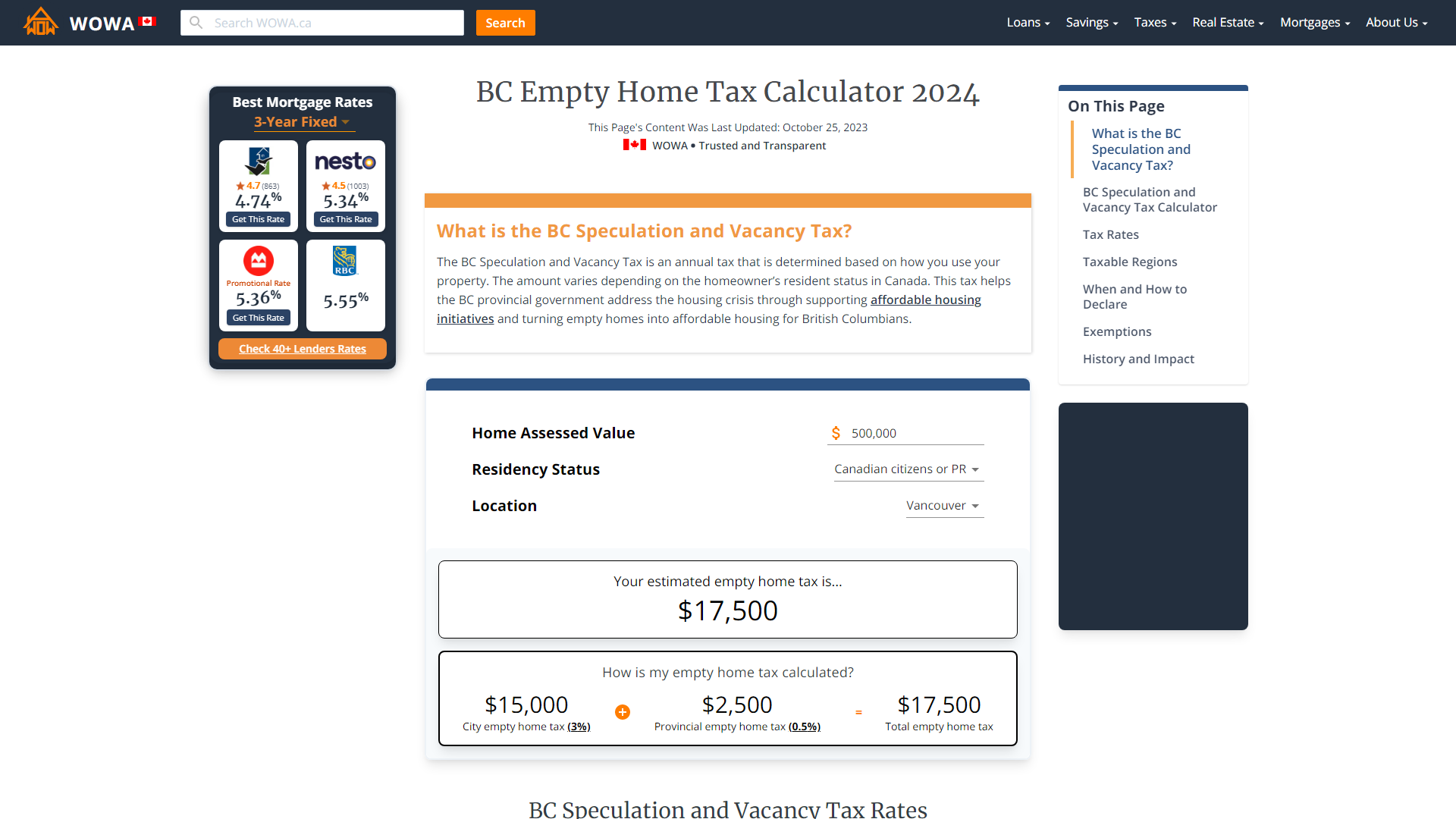

The information used to make the tax and exemption. 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts. Taxable and Exempt Accommodation Definitions For the purpose of PST and.

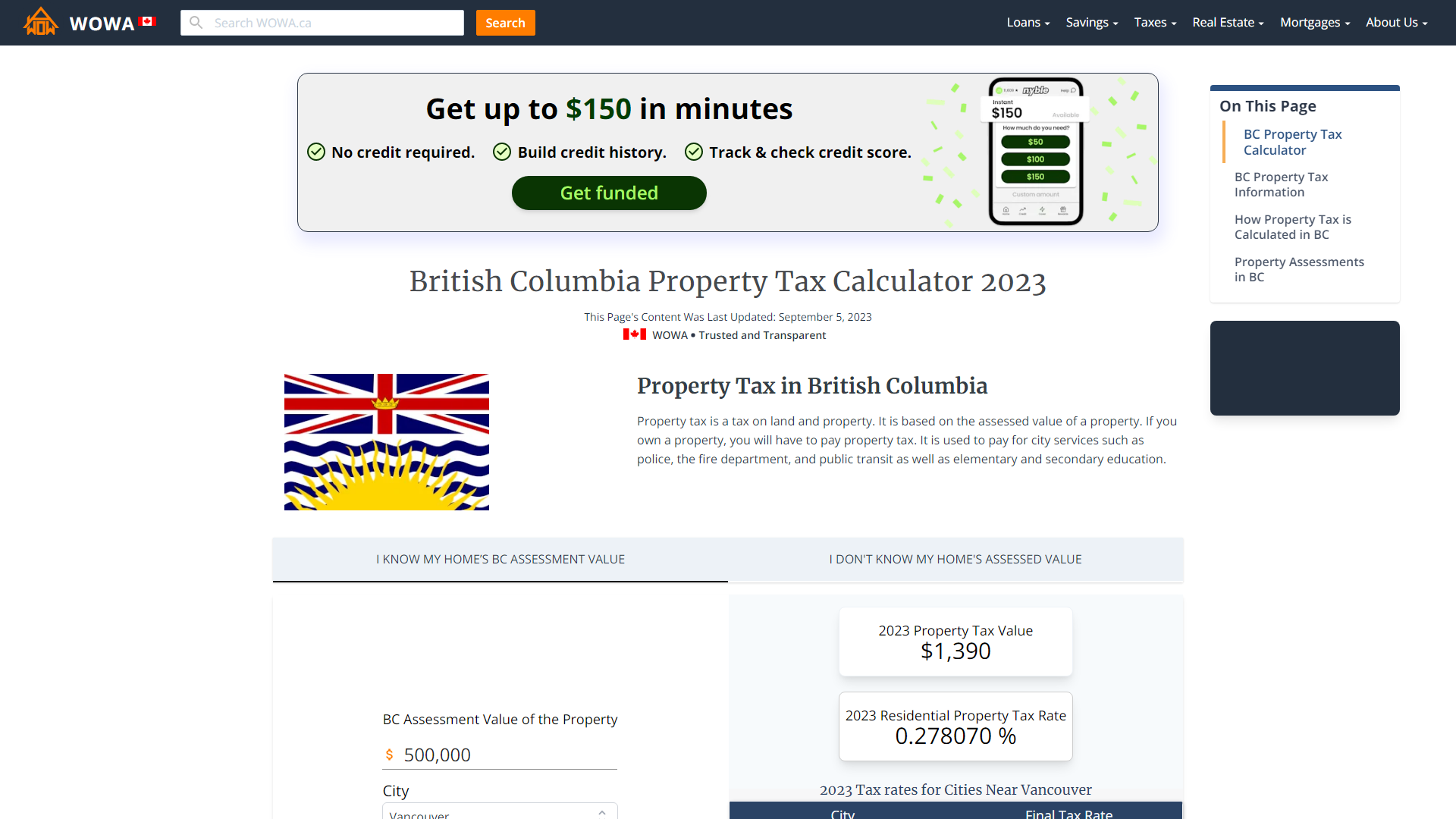

The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada. The rate you will charge depends on different factors see. For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest.

Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all. Type of supply learn about what. For example if your.

If you make 52000 a year living in the region of British Columbia Canada you will be taxed 13446. The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. Select the appropriate tax rates for the desired service area and property class by clicking on the box to the right.

This new rate will apply to all. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada. The British Columbia Annual Tax Calculator is updated for the 202021 tax year.

This is any monetary. Authorized by hotel associations on a. Hotel Room Rates and Taxes.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions. A tax rate increase will only take effect after an application has been approved by regulation. 1 This regulation may be cited as the Hotel Room Tax Regulation.

In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations with four or more. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax.

That means that your net pay will be 38554 per year or 3213 per month. GST 5 PST 7 on most goods and services. Avalara automates lodging sales and use tax compliance for your hospitality business.

When all the rates have been selected click on any of the Calculate buttons to. The tourism tax rate in Alberta is 4 and is called Tourism Levy tax. The City of Vancouver recently announced that the Vancouver Empty Home Tax will increase to 3 in 2021 compared to 125 in 2020.

Sales taxes make up a significant portion of BCs budget. The Alberta Annual Tax Calculator is updated for the 202021 tax year. A tax rate increase will only take effect after an application has been approved by regulation.

Income Tax Calculator British Columbia 2021. 2021 free British Columbia income tax calculator to quickly estimate your provincial taxes. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations.

The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. Current GST and PST rate for British-Columbia in 2019. BC Revenues from Sales Taxes.

Current GST and PST rate for British-Columbia in 2021.

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Average Room Rate Occupancy Revpar Revenue Metrics For B Bs

Atlantic Canada Property Tax Rates Calculator Wowa Ca

New Brunswick Sales Tax Hst Calculator 2022 Wowa Ca

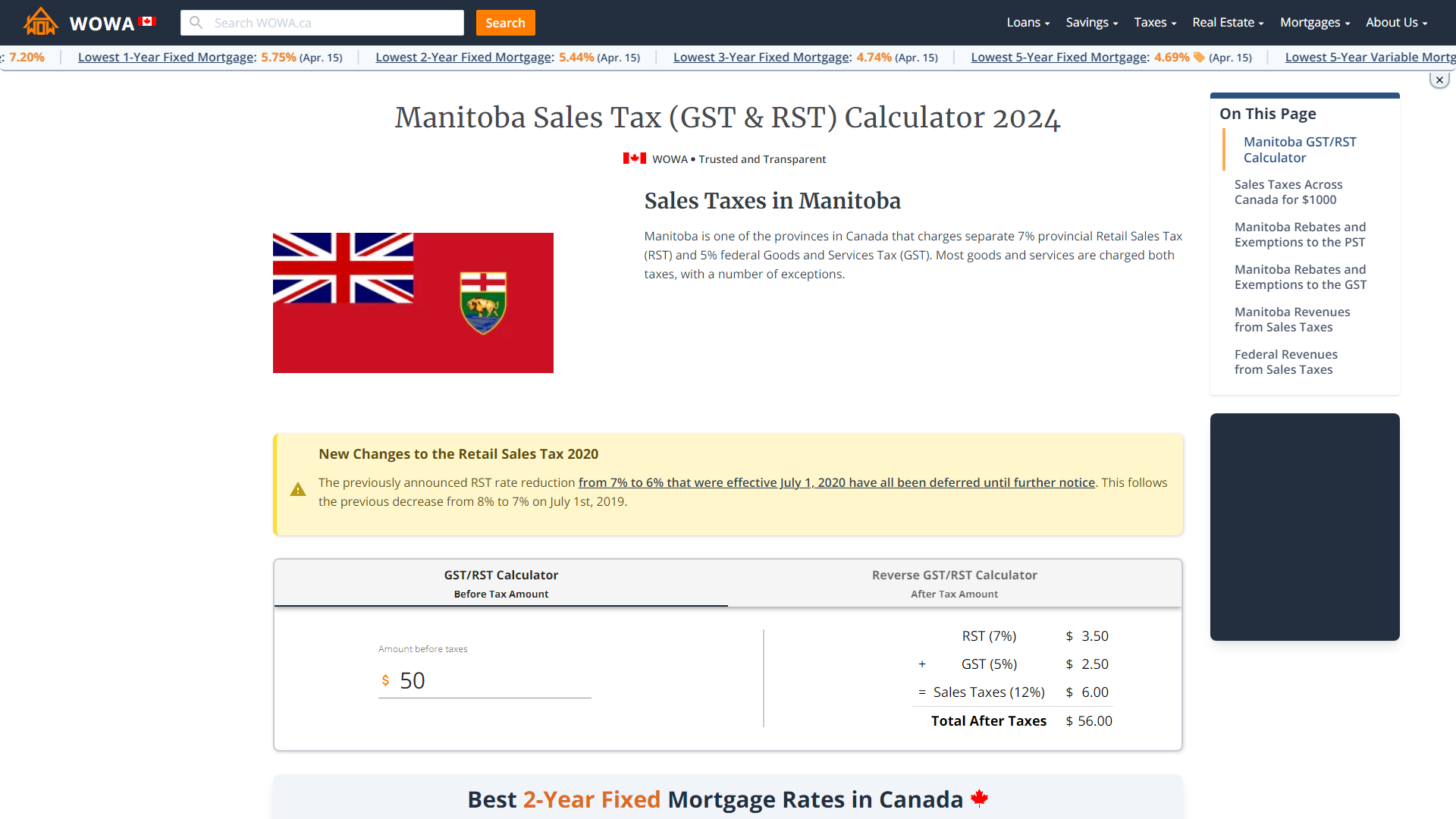

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Mortgage Rates Are Now Breaking To New Lower Territory And They Could Stay There For Months Real Estate Estates Rural Real Estate

![]()

Set Of Color Flat Design Icons By Creative Graphics On Creativework247 Flat Design Icons Icon Design Web Design Icon

Mortgage Formula Cheat Sheet Home Loan Math Made Simple Mortgage Loans Mortgage Rates Today Types Of Loans

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Second Hand New International Tax Advisor Tax Advisor Post Free Ads Advisor

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

Park Seven Klcc Malaysia Condo Beach Apartment Condominium Park