owner's draw vs salary uk

An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use. All business owners ask whether they should pay themselves a salary or drawings.

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

The title of the account for recording R.

. Dividends paid by a company to a shareholder out of after-tax profits are taxable for that shareholder. Multiple-member LLC members are considered to be. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the owners equity in the business.

The National Insurance rate for employees is 12 between 8632 and 50024 and 2 above this figure. The business owner takes funds out of the business for personal use. The reason for this is because a salary attracts a National Insurance levy.

64 09 358 5656 Auckland New Zealand. For example lets say an LLC has two members with one owning 60 of the company while the other owns 40. Download this guide to the owners draw now.

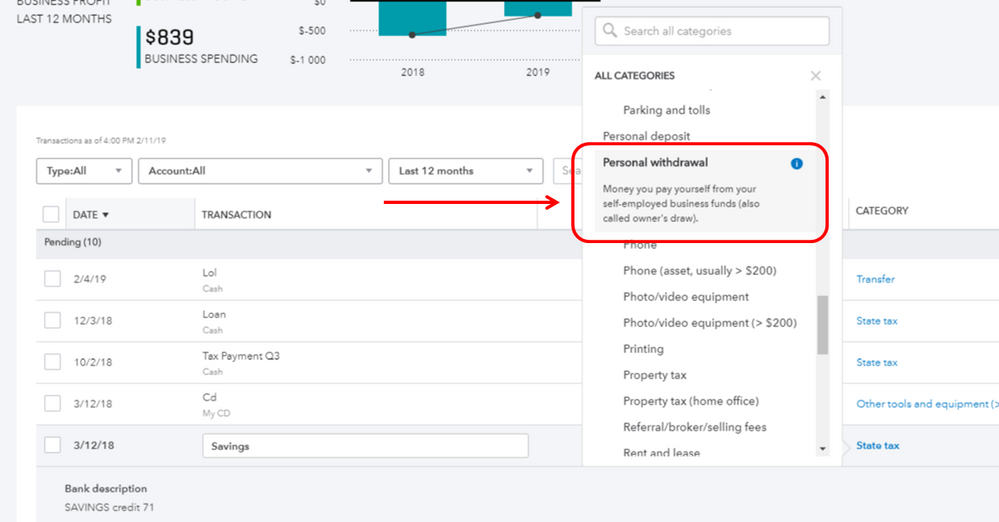

In the Chart of Accounts window select New. A draw is usually smaller than the commission potential and any excess commission over the draw payback is extra income to the employee with no limits on higher earning potential. Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the.

Report Inappropriate Content. The S corporation is saving him 82650 in medicare tax. Nil tax up to personal allowance of 12500 used 8784 for salary and 3716 for dividends No tax on dividends of 2000 due to the dividend allowance.

These amounts are commonly referred to as an owners draw. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck. The Draw acct should be zeroed out to Owners Capital Sole Pro or Retained Earnings Corp at the end of each accounting period - a calendar or fiscal year - which ever one your business uses.

When an employee accepts a draw he is relying heavily on his performance and has. What Is An Owners Draw. Total income is 3000000.

Understand the difference between salary vs. Not exactly a fortune but if it was. Single-member LLC owners are considered to be sole proprietors for tax purposes so they take a draw like a sole proprietor.

Owners equity is made up of a variety of funds including money youve invested in your company. Through the payment of dividends a salary or drawings. Technically an owners draw is a distribution from the owners equity account an account that represents the owners investment in the business.

Before you can decide which method is best for you you need to understand the basics. From the Account Type drop-down choose Equity. Depending on your business structure you may be able to pay yourself an owners draw.

Select the Gear icon at the top and then select Chart of Accounts. You would do this by Journal Entry. Am I entering Owners Draw correctly.

The members have agreed. Weve built a handy reference sheet that outlines how owners can be paid. From the Detail Type drop-down choose Owners Equity.

Alternatively if dividend compensation is chosen the company pays corporate tax on the income earned and the owner-manager pays personal tax when. Owners draws are withdrawals of a sole proprietorships cash or other assets made by the owner for the owners personal use. Take into account any salary already earned from a previous job if applicable when working out how much further salary you wish to draw down in the current tax year.

The current tax-free personal allowance is 12570 so if your salary is less than this amount you will have no PAYE income tax to pay at all. What is an owners draw. Salary and Bonuses.

If salary compensation is chosen the corporation claims a deduction against its income for the amount of salary or bonus paid and the owner-manager pays personal tax on the salary or bonus income received. Salaries paid are tax deductible for your company reducing its profits and taxable income and therefore the amount of company tax it pays. There are pros and cons to both and we examine the issues.

Heres a high-level look at the difference between a salary and an owners draw or simply a draw. LLC Owners Take a Draw or Distribution. Owners of limited liability companies LLCs called members are not considered employees and do not take a salary as an employee.

The owner takes a salary of 150000 leaving 2850000 to flow through. Then each member gets taxed on their distribution of profits. Its a way for them to pay themselves instead of taking a salary.

A salary draw is used in industries in which compensation is based on performance. Generally when operating as a Company Shareholders have three options as to how they can extract profits from the business. These industries often use commission as a primary or sole form of compensation and while this is not attractive to everyone it is appealing to some.

The account in which the draws are recorded is a contra owners capital account or contra owners equity account since its debit balance is contrary to the normal credit balance of the owners equity or capital account. 35500 41216 less 3716 less 2000 dividends taxable at 75 - 2663. At this level of dividends you will have basic rate tax to pay of 2663 calculated as follows.

Salary is direct compensation while a draw is a loan to be repaid out of future earnings. Directors of owner-managed companies often draw low levels of salary typically between 7500 and 9500 per annum. If the company has already paid tax and franking credits on the dividend are available the.

This article will explain the difference between salaries dividends and drawings and the effects each will have on your business. To create an Equity account. Draws can happen at regular.

An owners draw occurs when a business owner withdraws funds from their company for personal use rather than paying themselves a salary.

How To Pay Yourself As A Business Owner Leadership Girl Business Owner Operations Management Business

Graphic Designers Jobs Career Salary And Education Information Education Information Graphic Design Education

Unique Start Up Budget Template Xls Xlsformat Xlstemplates Xlstemplate Business Budget Template Business Expense Small Business Expenses

How To Pay Yourself From Your Business Salary Vs Draw And How Much Business Business Entrepreneur Online Boutique Business

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

Pdf Employment Contract Template Uk The Cheapest Way To Earn Your Free Ticket To Pdf Employ Contract Template Contract Business Budget Template

How To Pay Yourself As A Small Business Owner Gusto

How To Decide What To Pay Yourself As A Small Business Owner Personal Financial Statement Small Business Owner Business Owner

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner 2021 Small Business Consulting Consulting Business Business Management Degree

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

Solved Owner S Draw On Self Employed Qb

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner 2021 Salary Business Owner Business

Solved Owner S Draw On Self Employed Qb

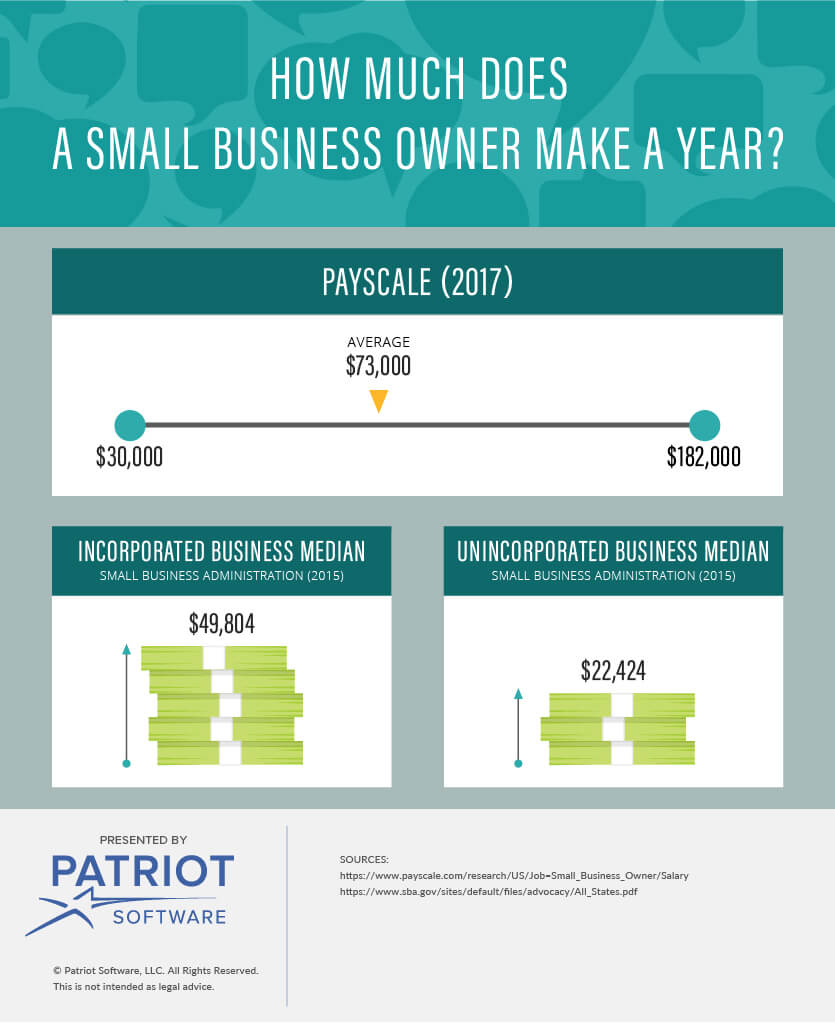

How Much Do Small Business Owners Make Surprising Averages

How A Sole Proprietor Pays Income Tax And Other Taxes Sole Proprietor Income Tax Income

Business Owner Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Quickbooks Uk Blog